puerto rico tax incentives act 20

And promote the development of new businesses in Puerto Rico. For example Law 73 the Economic Incentives Act for the Development of Puerto Rico was established to provide the adequate environment and opportunities to continue developing a.

The 2016 Puerto Rico Investment Summit Series Begins February 11 2016 Puerto Rico Luxury

The New Incentives Code.

. View the benefits of allowing us to manage your Puerto Rican tax incentives. In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent.

Get to know about Puerto Rico Tax Act 20 and Tax Act 22 to minimize your tax liability. Find out how your business can benefit from the new tax laws in Puerto Rico. 20 of 2012 as amended known as the Export Services Act the Act to offer the necessary elements for the creation of a World Class International Service Center.

In addition to Act 20 Puerto Rico also passed Act 22 known as the Individual Investors Act so as to attract wealthy individual investors to relocate to the Island. The most famous are Act 20 and Act 22now the Export Services and the Individual Resident Investor tax incentives respectively under the newly enacted Act 60but. Under this new law known as the Incentives Code Acts.

Puerto Ricos Act 20 also seeks to encourage local service providers to expand their services to persons outside Puerto Rico. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. Under the new rules If your Act.

With the tax incentives overhaul of 2019 a couple of new requirements were added to Act 22 beginning in January of 2020. Of particular interest are Chapter 2 of Act 60 for. The Act provides tax exemptions and tax credits to businesses engaged in eligible activities in Puerto Rico.

Under Act 20 income from eligible services. Puerto Rico Incentives Code 60 for prior Acts 2020. On the bright side conditions for Act 20 remained largely the same.

As financial experts we guide you through the process of Act 20 and 22 Tax benefits. The Torres CPA Group works diligently to ensure you understand all of the laws regarding your Puerto Rico. Act 20 provides tax incentives for companies that establish and expand their export services businesses in Puerto Rico.

On January 17 2012 Puerto Rico enacted Act No. Along with the long-standing bona fide residence requirement. In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or Economic Incentives Act went into effect.

Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020. Citizens that become residents of Puerto Rico. On January 17 2012 Puerto Rico enacted Act No.

Call us now at 404-445-8095 or request a consultation online. Puerto Rico US Tax. Legislative acts producing tax advantages in Puerto.

Act 60 Former Acts 2022 In January of 2012 the Government of Puerto Rico signed into law both Act 20 and 22 providing aggressive incentives to urge investors to move to the Island to. The annual filing fee just for Act 22 also increased from 300 to 5000. Along with Puerto Rico Tax Act 20 Puerto Rico adopted an additional incentive the Act to Promote the Relocation of Individual Investors Puerto Rico Tax Act 22 to stimulate economic.

Taxes levied on their. Also during the year 2012 two additional laws. Act 20 provides an opportunity for firms established in Puerto Rico with local or non-local capital to export services at a preferential tax rate among other benefits.

20 of 2012 as amended known as the Export Services Act the Act to offer the necessary elements for the creation of a. Many high-net worth Taxpayers are understandably upset about the massive US.

Accounting White Paper Examples Cpa White Paper Documents By Tcg

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Tumblr Puerto Rico Sotheby S Realty Sotheby Realty Luxury Real Estate Caribbean Travel

![]()

Puerto Rico S Aggressive Tax Incentives Talented Local Crews Varied Backdrops Solid Infrastructure And Sound Legal Protections Puerto Puerto Rico Incentive

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

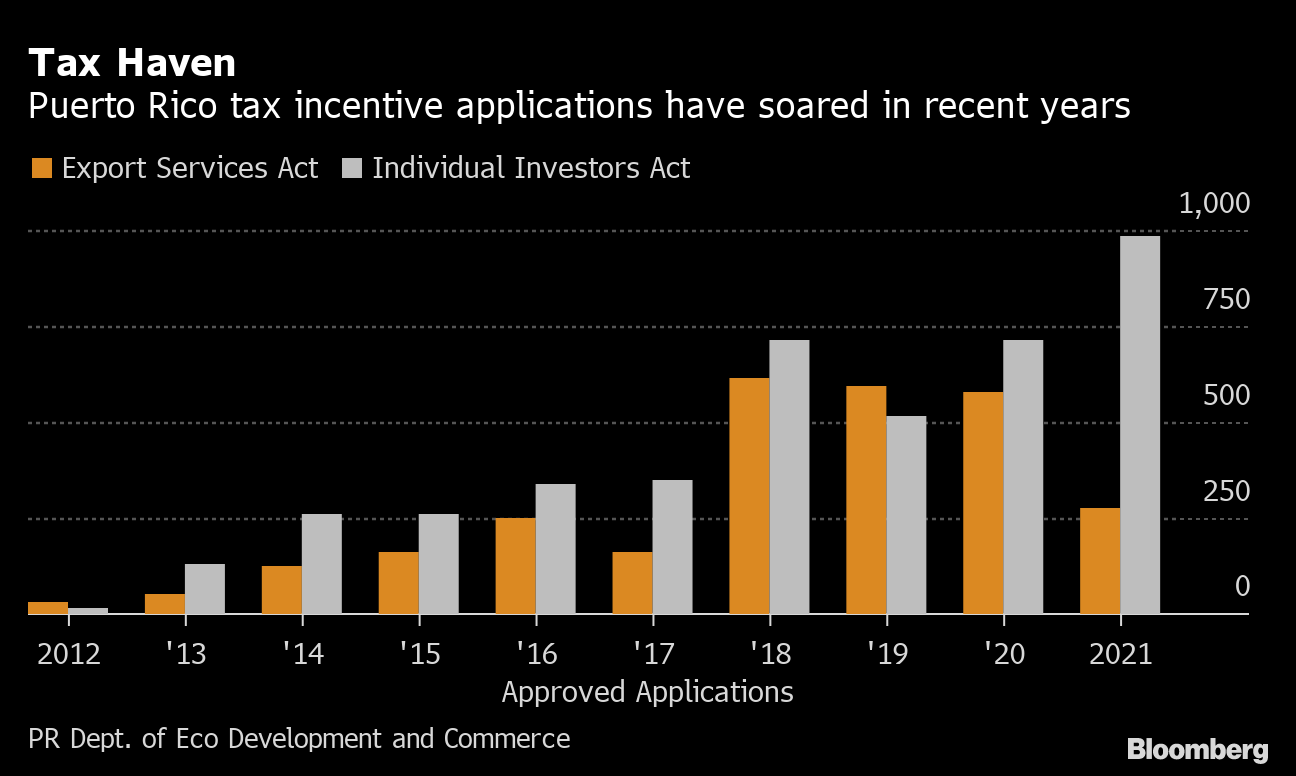

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

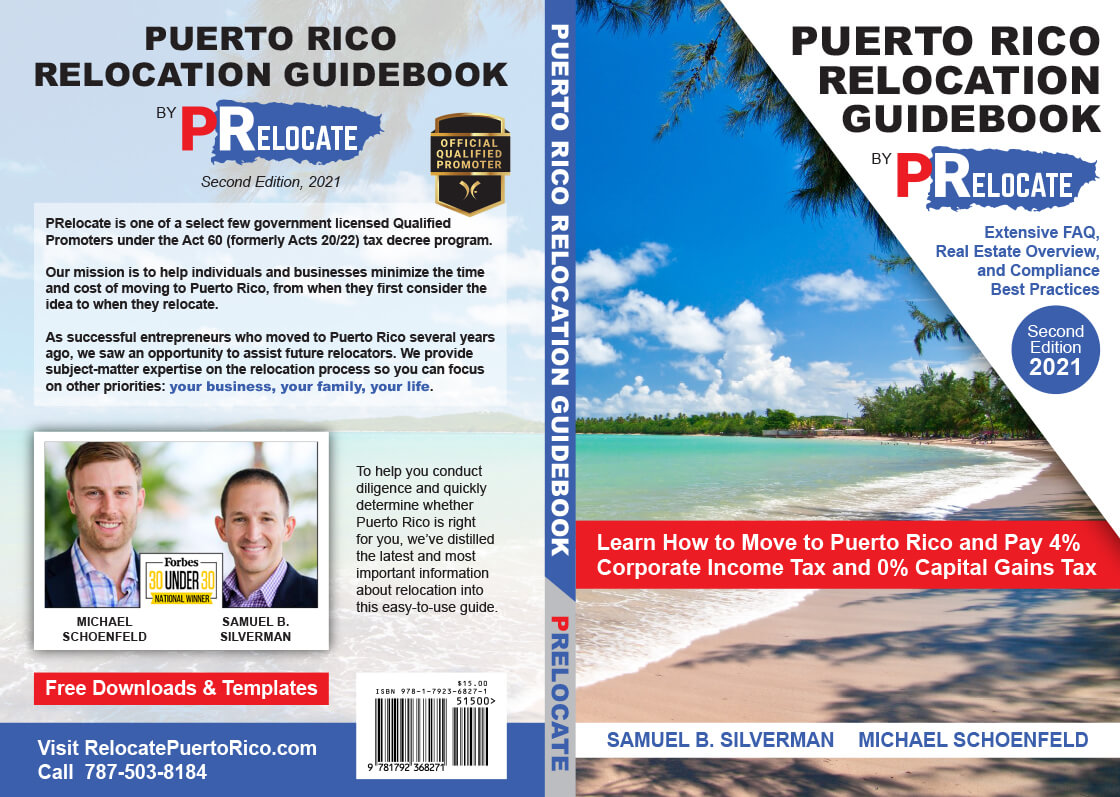

Pr Relocation Guidebook Long Relocate To Puerto Rico With Act 60 20 22

New Puerto Rico Debt Plan Is A False Solution Crafted To Benefit Capitalists

Puerto Rico S Aggressive Tax Incentives Talented Local Crews Varied Backdrops Solid Infrastructure And Sound Legal Protections Puerto Puerto Rico Incentive

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Act 20 22 Act 73 Puerto Rico Puerto Rico Vieques Luxury Property For Sale

Puerto Rico Tax Incentives Updated August 2020 Act 60 Replaces Act 20 Act 22 Youtube

Puerto Rico Offers The Lowest Effective Corporate Income Tax

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Why I Really Moved To Puerto Rico And You Should Too Doug Casey S International Man